reduce your student loan by up to $300 a month

(yes, really)

Welcome to StuLo

At $1.5 trillion, student loan debt is an issue that is taking center stage in the United States, and many employers are looking to find a solution.

StuLo offers a wholistic approach that focuses on financial wellness, student loan debt relief, and credit repair services to provide a solution for all employees — and not just those with student loans. Voluntary and low-cost options are available.

Student Loan Relief Benefits

Federal Loan Concierge / Public Service Loan Forgiveness

Over $300 per month in reduced payments for StuLo members last year

End-to-end service provided by student loan specialists who educate, handle all document preparation and process management services to help with federal loan consolidation and modification programs.

Assistance with Income-Based Repayment and Public Service Loan Forgiveness (PSLF) qualification.

Private Loan Refinance

Up to 40% loan payment reduction / Average savings $15K

Online platform with access to over 300 community banks and credit unions with instant decisions for private and federal loan refinancing.

Financial Wellness Benefits

Credit Repair Concierge

Improvements within 30-45 days

Full-service repair counselors to handle all document preparation and process management service to help improve FICO credit scores.

What makes StuLo different?

- Wholistic solution of financial benefits for all members and employees

- Concierge service with one-to-one human touch

- Not a singular-focused student loan solution – employee/member choice

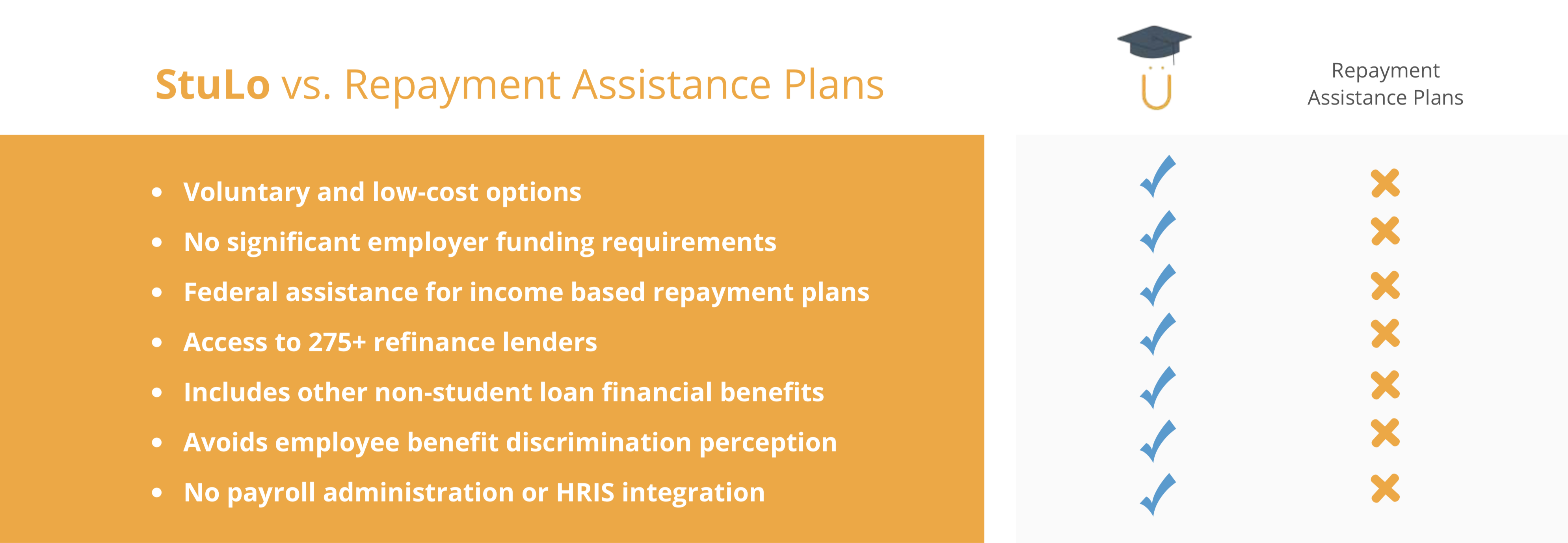

- Significantly greater benefit value than a repayment assistance plan

- No payroll administration: direct-bill

- Best-in-class and industry leading service partners

Employers

Designed for large-sized companies who are looking for a voluntary or low-cost financial wellness benefit solution–with unmatched value–for all their employees.

Associations

For Alumni, Trade, and Professional associations looking for a meaningful financial wellness benefit to use as a member recruitment and retention tool.

Members

How It Works

-

Schedule a free 30-minute call with one of our Student Loan Specialists to review your loans and financial situation

-

Review your financial goals with us

-

By the end of the call we outline how much we can reduce your loans, our program to help you achieve your goals, and the cost to use StuLo (there is a one-time fee required to refinance your loans).

-

As soon as you decide to work with us, StuLo starts renegotiating your student loans (and during this 30-45 day period, you do not make any loan payments)

-

Once StuLo finalizes your new loan amount, lower interest rate, and term length, you sign your brand new, lower cost loan and resume making your monthly payment

On average, we help over 60% of the people we meet with! So subscribe to the LIVING 2.0 Rewards program, and schedule your call as soon as possible to see if we can help you. Remember, the consultation is absolutely FREE!

Student Loan Debt Relief Benefits can

Help to Provide Financial Freedom

67% of student loan holders are age 39 or younger (29.5 million)

3rd most important benefit ranking of student loan debt relief behind health insurance and 401(k) match

86% of millennials would stay with an employer > 5 years if student loan relief benefit was offered

Financial Wellness Benefits can

Help to Increase Productivity

64% of younger workers indicated they are stressed about their finances

46% spend 3 or more hours per week dealing with personal finances at work

63% are unable to handle an unexpected medical bill of $1,000

Meaningful Benefits for All Members

Not just for student loan holders

Some benefit solutions are singular-focused only on student loans. With StuLo, you get a wholistic financial wellness solution that will appeal to a broad range of people – not just those with student loan debt.

Student Loan Related Benefits

Federal

Student Loan

Concierge

Private

Student Loan

Refinancing

Financial Wellness Related Benefits

Financial

Coaching

Credit Repair

Concierge

Identity Theft

Protection